| Name of Post: |

PM Jan Dhan Yojana . Online Account Opening & Application Form Status at pmjdy.gov.in

|

| Post Update: |

15 May 2021 | 06:26 AM

|

| Short Information : |

www.pmjdy.gov.in Application Form & online registration, Account Status 2020 List: Pradhan Mantri Jan-Dhan Yojana (PMJDY) has announced by the Department of Financial Services Ministry of Finance Government of India. The प्रधानमंत्री जन धन योजना क्या है, के उद्देश्य, की जानकारी, लाभ & ऑनलाइन अप्लाई is a national level Financial Inclusion which is useful for Indian Nationals to ensure access to financial services namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner. Aspirants can check the Benefits & Beneficiary List at pmjdy.gov.in. Candidates can open the accounts in any bank branch or Business Correspondent (Bank Mitr) outlet. Banks will be opened Jan Dhan Accounts with Zero balance. Scheme beneficiaries can also get a cheque book facility, which will have fulfill minimum balance criteria. Check the direct link of the Online Account Opening & Application Form from the below section.

|

Join On Telegram Click Here

Department of Financial Services Ministry of Finance Government of India

PM Jan Dhan Yojana 2020

|

✍ कोरोना वायरस के कारण जो लॉक डाउन हुआ है उसमे सरकार की तरफ महिला जन धन खाता धारकों को अगले तीन महीने तक हर माह 500 रुपये मिलेंगे!

Pradhan Mantri Jan Dhan Yojana 2020 Status

Pradhan Mantri Jan Dhan Yojana (PMJDY) is one of the biggest financial inclusion initiatives in the whole world. The PMJDY scheme was announced by the Prime Minister of India, Shri Narendra Modi on 15th August 2014. PM Narendra Modi has launched this scheme on 28th August 2014. Under scheme aspirants can access banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension.

|

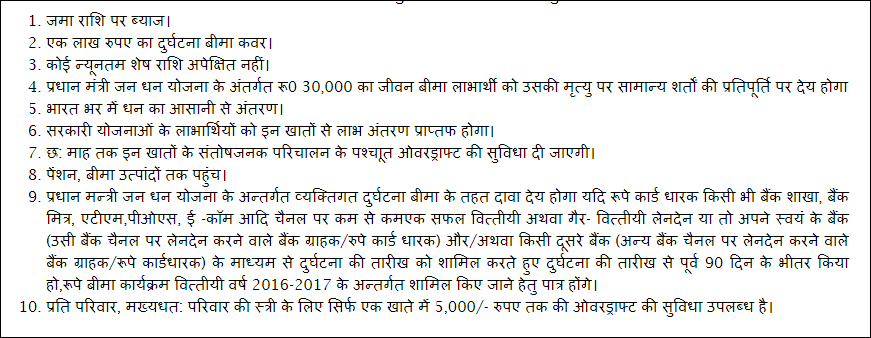

प्रधानमंत्री जन-धन योजना (पीएमजेडीवाई) राष्ट्रीय वित्तीय समावेशन मिशन है जो वहनीय तरीके से वित्तीय सेवाओं नामतः, बैंकिंग/बचत तथा जमा खाते, विप्रेषण, ऋण, बीमा, पेंशन तक पहुंच सुनिश्चित करता हो।

खाता किसी भी बैंक शाखा अथवा व्यवसाय प्रतिनिधि (बैंक मित्र) आउटलेट में खोला जा सकता है। पीएमजेडीवाई खातों जीरो बैलेंस के साथ खोला जा रहा है। हालांकि, खाता धारक अगर किताब की जांच करना चाहती है, वह / वह न्यूनतम बैलेंस मानदंडों को पूरा करना होगा।

The PM Narendra Modi has declared the 21 Day’s Lockdown in India due to Coronavirus (COVID-19). Nobody allowed to go to any place to meet someone. The Indian Government has stopped all gathering occasions like religious gatherings, marriage ceremony or Fair gatherings because the virus reaches from one person to another. All persons need to follow the social distancing to stop this infection. Due to lockdown, all peoples are jobless and they do not have enough money to survive. So Govt. has decided to give Rs. 500/- to each woman into their Jan Dhan accounts. All women can get benefits who having Mahila Jan Dhan Khata. Beneficiaries can debit this money from ATM because banks are closed due to lockdown.

|

| Authority |

Government of India |

| Name of Department |

Department of Financial Services Ministry of Finance |

| Scheme Name |

Pradhan Mantri Jan Dhan Yojana (PMJDY) / प्रधानमंत्री जन धन योजना |

| Schemes under the PMJDY |

Pradhanmantri Jeevan Jyoti Bima Yojana,

Pradhanmantri Suraksha Bima Yojana

Atal Pension Yojana

Pradhanmantri Mudra Yojana |

| Total No. of Beneficiary Accounts |

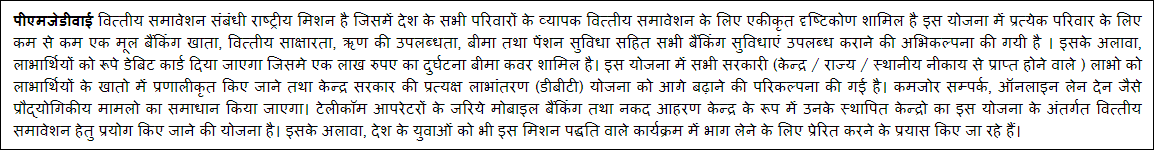

38.33 Crore |

| Paid Amount to Beneficiaries |

Rs. 118,434.41 Crore |

| Total Bank Mitras |

1.26 Lakh |

| Fresh Announcement |

Rs 500 /- Deposit in Jan Dhan Account for next 3 Months in LockDown

करोना वायरस के कारण जो लॉक डाउन हुआ है उसमे सरकार की तरफ महिला जन धन खाता धारकों को अगले तीन महीने तक हर माह 500 रुपये मिलेंगे! |

|

|

|

PMJDY Scheme 2020 Details

The Government has decided to extend the comprehensive PMJDY program beyond 28.8.2018 with the change in focus on opening accounts from “every household” to “every adult”, with the following modification:

▶ Existing Over Draft (OD) limit of Rs. 5,000 revised to Rs. 10,000.

▶ No conditions attached for active PMJDY accounts availing OD upto Rs. 2,000.

▶ Age limit for availing OD facility revised from 18-60 years to 18-65 years.

▶ The accidental insurance cover for new RuPay card holders raised from existing Rs.1 lakh to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018.

PM Jan Dhan Scheme Yojana Benefits in Hindi✎ Interest on deposit.

✎ Accidental insurance cover of Rs. 2 lakhs.

✎ No minimum balance required.

✎ The scheme provides life cover of Rs. 30,000/- payable on the death of the beneficiary, subject to fulfillment of the eligibility condition.

✎ Easy Transfer of money across India.

✎ Beneficiaries of Government Schemes will get Direct Benefit Transfer in these accounts.

✎ After the satisfactory operation of the account for 6 months, an overdraft facility will be permitted.

✎ Access to Pension, insurance products.

✎ The Claim under Personal Accidental Insurance under PMJDY shall be payable if the Rupay Card holder has performed minimum one successful financial or non-financial customer induced transaction at any Bank Branch, Bank Mitra, ATM, POS, E-COM etc. Channel both Intra and Inter-bank i.e. on-us (Bank Customer/Rupay card holder transacting at same Bank channels) and off-us (Bank Customer/Rupay card holder transacting at other Bank Channels) within 90 days prior to the date of accident including accident date will be included as eligible transactions under the Rupay Insurance Program 2019-2020.

✎ Overdraft facility upto Rs. 10,000/- is available in only one account per household, preferably lady of the household.  Document Required for Pradhan Mantri Jan-Dhan Yojana

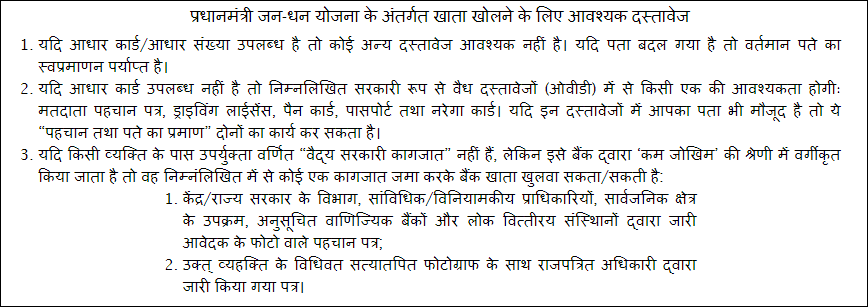

✔ Passport.

✔ Driving Licence.

✔ Permanent Account Number (PAN) Card.

✔ Voter’s Identity Card .

✔ NREGA Job Card.

✔ Aadhar Card with Permanent Address Proof.

✔ Any other document as notified by the Central Government.

✔ Officially valid documents:

Identity card with applicant’s photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks, and Public Financial Institutions.

✔ Letter issued by a Gazetted officer, with a duly attested photograph of the person.

|

Authorized Bank List

- Allahabad Bank >> Account Open Link

- Andhra Bank >> Account Open Link

- Bank Of Baroda (BoB) >> Account Open Link

- Bank Of India (BOI) >> Account Open Link

- Bank Of Maharashtra >> Check Here

- Bhartiya Mahila Bank

- Canara Bank >> Check Here

- Central Bank Of India >> Account Open Link

- Corporation Bank >> Check Here

- Dena Bank >> Check Here

- IDBI Bank >> Account Open Link

- Indian Bank >> Check Here

- Oriental Bank of Commerce >>> Account Open Link

- Punjab National Bank (PNB) >> Check Here

- Punjab & Sind Bank >> Account Open Link

- State Bank of India (SBI) >> Check Here

- Syndicate Bank >> Check Here

- Union Bank of India >> Account Open Link

- Vijaya Bank >> Account Open Link

|

Schemes Under PMJDY

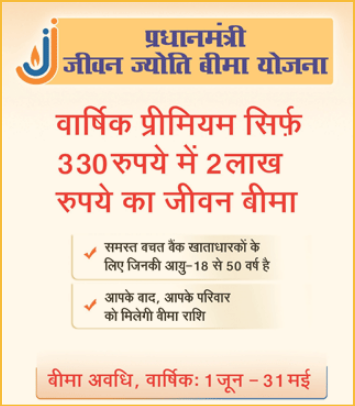

Pradhanmantri Jeevan Jyoti Bima Yojana

Life Insurance worth ₹ 2 Lacs at just ₹ 330 per Annum

✔ For all Bank account holders whose age is between 18 to 50 Years.

✔ Life Insurance amount for your family after you.

✔ Period of Insurance, Annual: 1st June – 31st May.

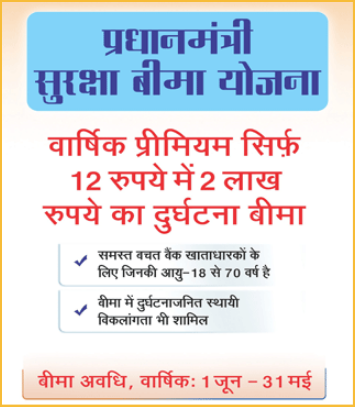

Pradhanmantri Suraksha Bima Yojana

Accident Insurance worth ₹ 2 Lacs at just ₹ 12 per Annum

✔ For all Bank account holders whose age is between 18 to 70 Years.

✔ Insurance also covers permanent disablement due to accident.

✔ Period of Insurance, Annual: 1st June – 31st May.

Atal Pension Yojana

Minimum Investment, Maximum Benefits during old-age.

✔ Fixed monthly pension from Rs. 1000 to Rs. 5000 depending on the contributions.

Brief on Atal Pension Yojana

|

|

|

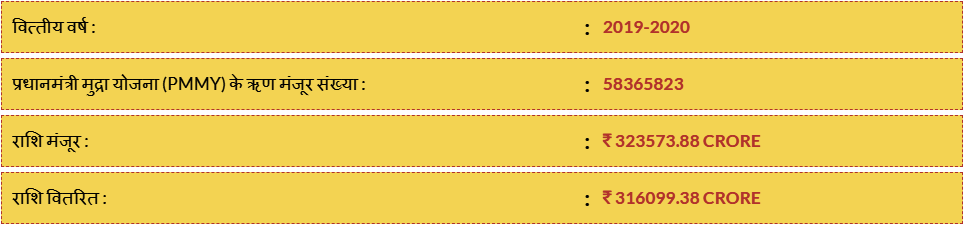

Pradhanmantri Mudra Yojana

The Hon’ble Prime Minister has launched a scheme named Pradhan Mantri MUDRA Yojana (PMMY) on 8th April 2015. PM MUDRA Yojana provides loans up to lakh to the non-corporate, non-farm small/micro-enterprises. Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs are giving the MUDRA loans under PMMY.

MUDRA VISION

“To be an integrated financial and support services provider par excellence benchmarked with global best practices and standards for the bottom of the pyramid universe for their comprehensive economic and social development.”

MUDRA MISSION

“To create an inclusive, sustainable and value-based entrepreneurial culture, in collaboration with our partner institutions in achieving economic success and financial security.”

PMMY Status 2020 Since Inception

✔ PMMY, MUDRA has created three products like ‘Shishu’, ‘Kishore’ and ‘Tarun’. Check the details about Products from the below section.

Shishu – Covering Loans Upto ₹ 50,000/-

Kishore – Covering Loans Above ₹ 50,000/- and Upto ₹ 5 Lakh

Tarun – Covering Loans above ₹ 5 Lakh and Upto ₹ 10 Lakh

Pradhan Mantri Jan Dhan Yojana Toll Free Number

Helpline Number :- 1800-180-1111/ 1800-11-0001

StateWise Toll Free Number |

IMPORTANT LINKS

|

|

|

|

|

PMJDY Account Opening Form

|

|

|

For any Query and Feedback Contact us -

|

|

|

|

|

|

|

|

| |